27+ Gross Up Calculator Excel

1 Tax Net Percent. I have a net number 1500.

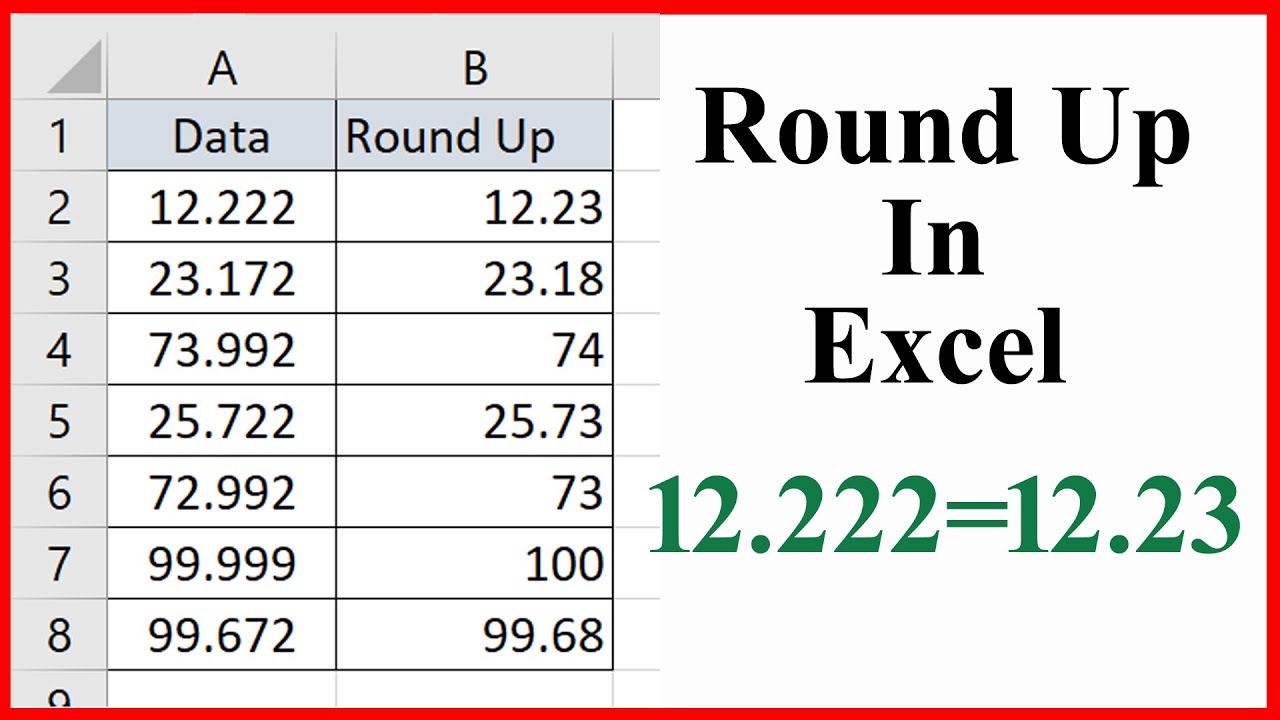

How To Round Up Numbers In Microsoft Excel Youtube

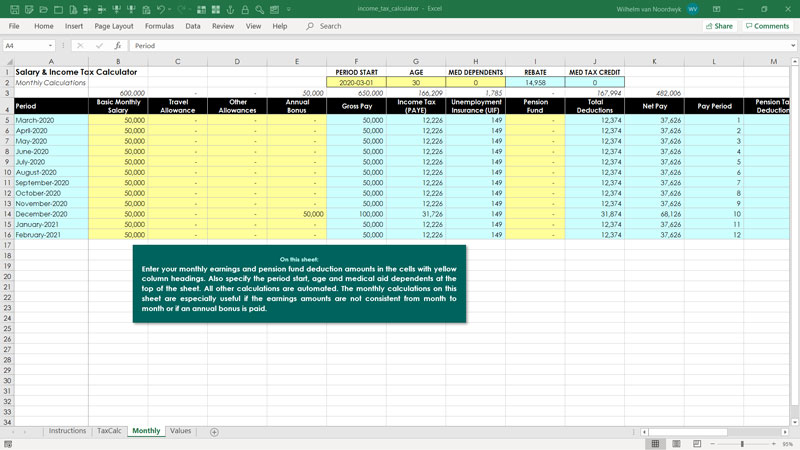

Gross pay Calculation W-4 Form information Pre-Tax Adjustments Federal Withholding Tax Calculations Post Tax.

. Make sure the number. You just need to enter your. Web Enter the amount of money youd like to take home each pay period and the gross pay calculator will tell you what your before-tax earnings need to be.

In this Relo Tip Tuesday Pluss Director of Finance Angela Sieber will tell you what you. Department pays Gross Up Amount. Web Paycheck Calculator Template consists of 6 sections.

Use this gross pay calculator to gross up wages based on net pay. Add up all federal state and local tax rates. Web Excel formula - Calculation to find a Gross Number.

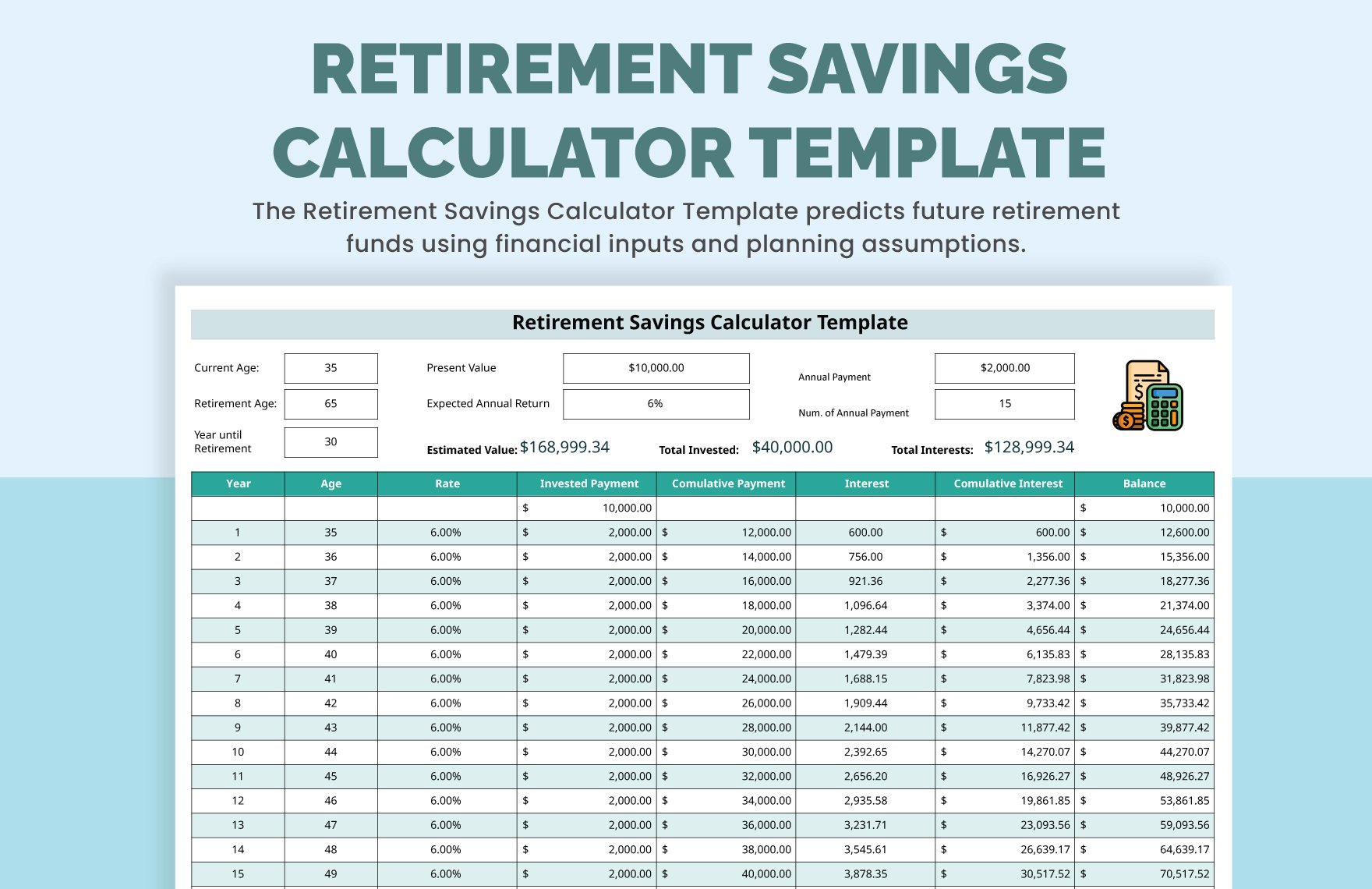

You can use this excel template to calculate your AGI. Web To calculate tax gross-up follow these four steps. To determine the amount add up all the tax rates fed state OASDI SS and then divide the total.

Web Calculate labor costs efficiently with a free labor cost calculator Excel First off you probably want to know what a labor cost calculator Excel spreadsheet even is. Web We have created an easy and ready to use Adjusted Gross Income Calculator in excel. Web If you want to experiment with our gross-up calculator you can calculate gross pay based upon take-home pay and allow for adjustments in 401k contribution amount.

Web How can I use MS Excel to calculate the required gross amount for a financial distribution when all you know is the net amount less taxes. Web There are a lot of options when it comes to calculating gross-up. I am looking for an excel formula that will calculate the below.

Subtract the total tax rates from the number 1. And you have of shares outstanding to be allotted in cell A2 ie 4. I need to determine what Gross.

Web With this method employers pay a gross-up on the gross-up. Web Use our free Gross Pay Calculator by inputting your net pay pay frequency filing status state amount paid to date and any withholding and deductions to calculate your gross. For example if an employee receives.

Web Hi Fred Lets say you have the shares outstanding in cell A1 ie 10000. Employee receives FICA Tax 62. Web Use the Excelforce Services Gross Up Calculator to calculate the gross amount an employee must use for payroll taxes and how much they can take home.

Web Simply enter the amount of net pay you want your employee to receive along with some details about any withholding preferences from their Form W-4 and our. Web The most accurate paycheck calculators for the last 20 years.

Purchase Order Template The Best Method To Make Your Purchase In The Correct Manner Is With The As Purchase Order Template Order Form Template Purchase Order

9 Retirement Calculator Templates In Pdf Doc

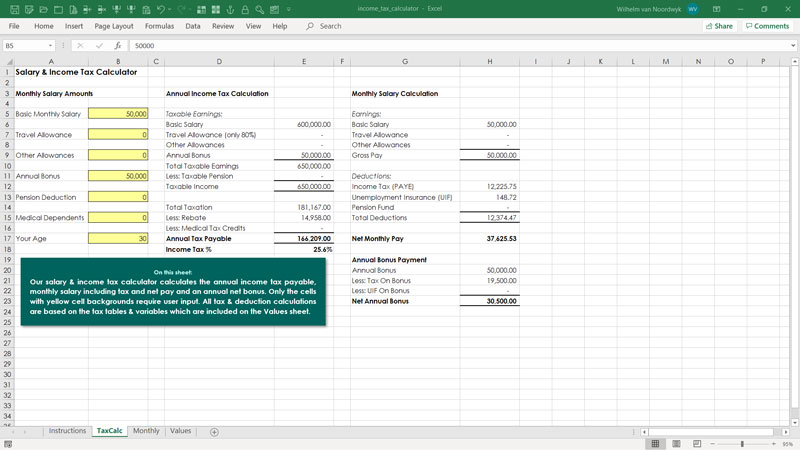

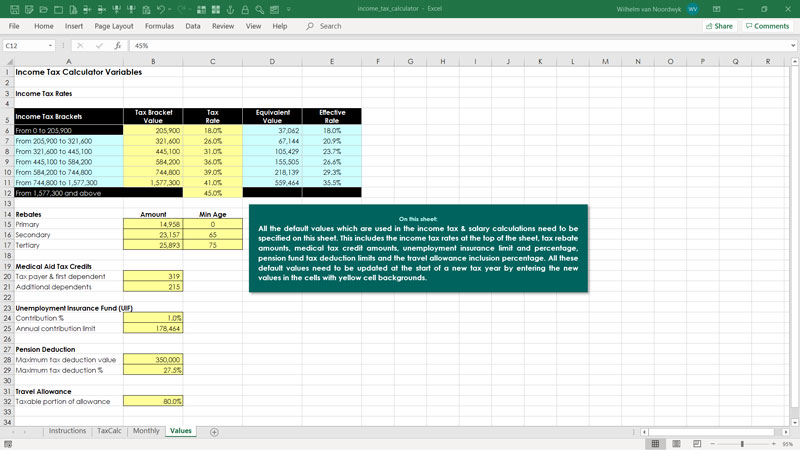

Computation Of Income Tax In Excel Excel Skills

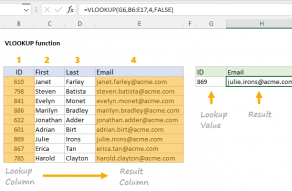

Excel Formula Calculate Grades With Vlookup Excelchat

Social Media Coming To The Mall A Cross Channel Response Springerlink

Ea Lot Sizing Calculator Excel Ea Trading Academy

Excel Gross Profit Margin Calculator Spreadsheet Free Download

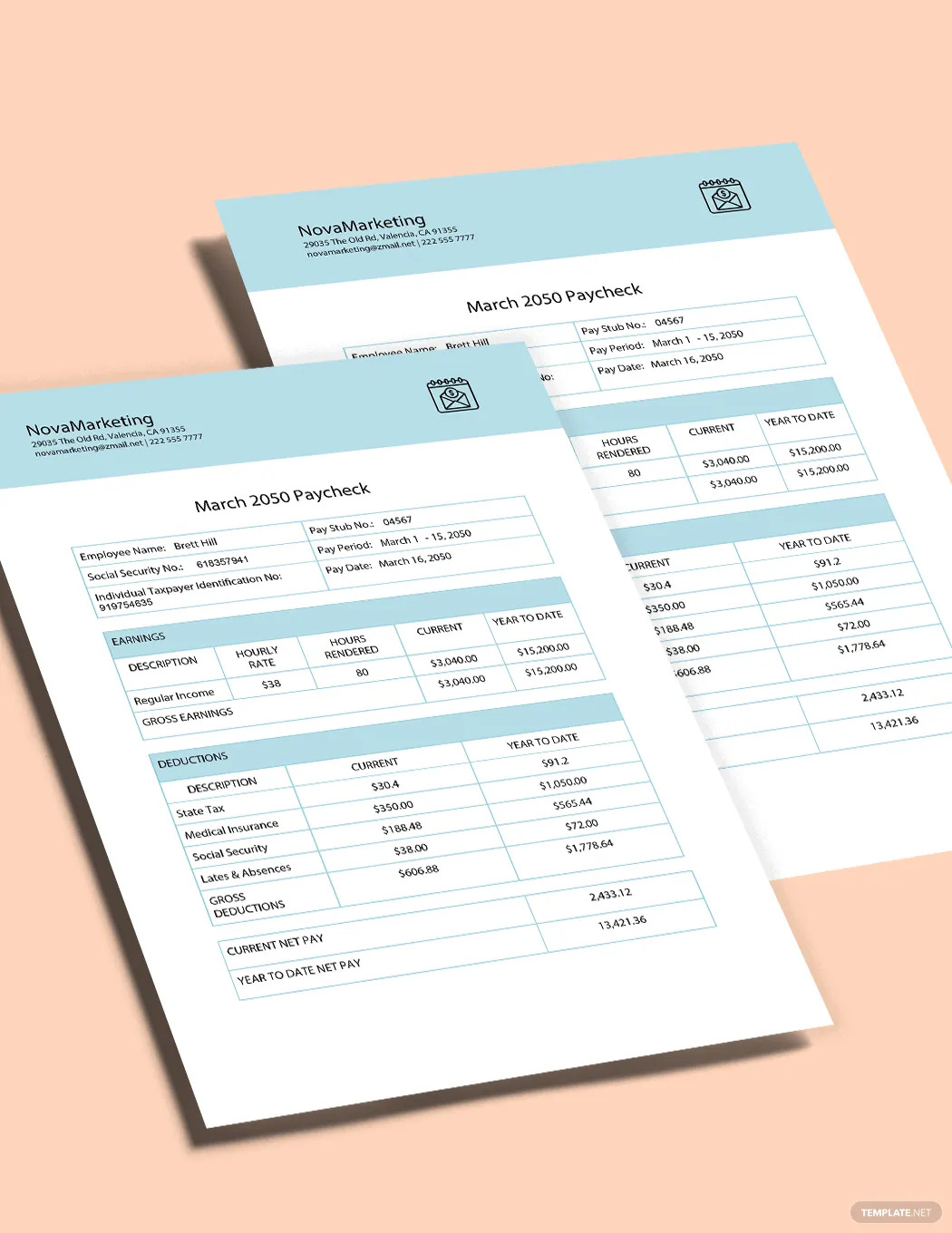

Paycheck What Is A Paycheck Definition Types Uses

Calculate Gross Pay Gross Up Payroll Calculator Excelforce

Computation Of Income Tax In Excel Excel Skills

Abstracts 2020 British Journal Of Haematology Wiley Online Library

Income Tax Bracket Calculation Excel Formula Exceljet

Computation Of Income Tax In Excel Excel Skills

Draft Methodological Working Paper Documenting The Methodological Approaches And Interlinkages For All Supply Models And Interfa

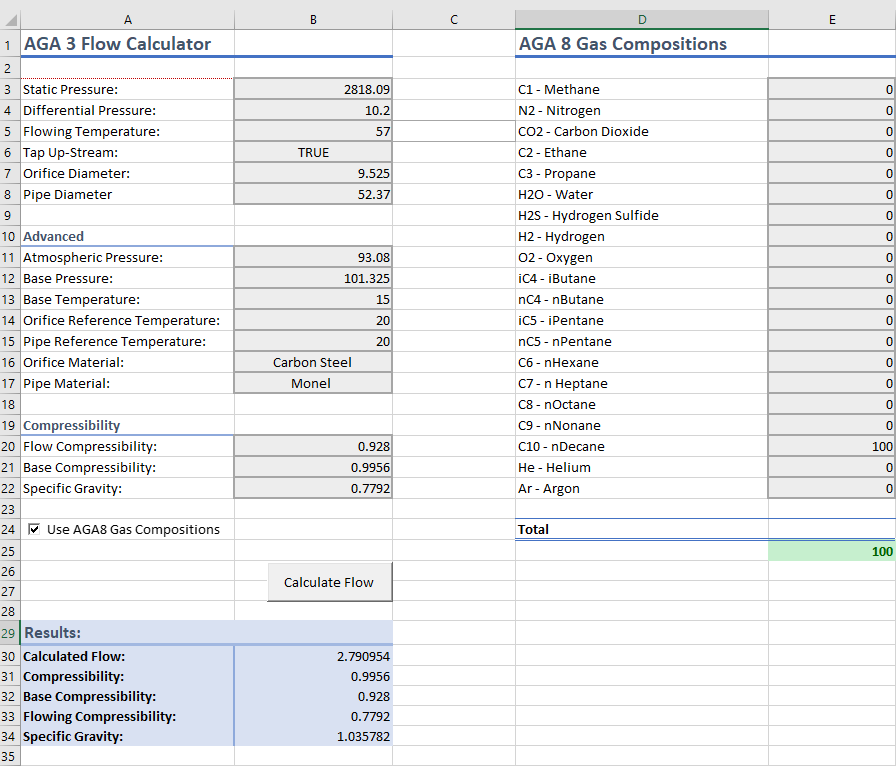

Aga Gas Flow Excel Calculator With Library Scadacore

Kpi Examples Here Are The Best 30 You Can Find In 2022

Income Tax Calculator Excel Step By Step Guide