Tim tax salary calculator

Its so easy to. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month.

Tax Calculators Taxtim Sa

DOL is increasing the standard salary level thats currently 455 per week to 684 per week.

. Your average tax rate is. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. That means that your net pay will be 43041 per year or 3587 per month.

15 Tax Calculators 15 Tax Calculators. It is mainly intended for residents of the US. How much do Tims Tax Service employees earn on average in the United States.

The results that the calculator give you are calculated with consideration to the most recent income tax and social security information available for the tax year 202223. Try out the take-home calculator choose the 202223 tax year and see how it affects. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total. Its never been easier to calculate how much you may get back or owe with our tax estimator tool.

Estimate your tax refund with HR Blocks free income tax calculator. Use our Small Business Corporation Income Tax calculator to work out the tax payable on your business taxable income. Thats equivalent to 35568 per year for a full-year worker.

Sage Income Tax Calculator. 2021 Tax Year Return. NO medical aid retirement allowances or other income.

Which tax year would you like to calculate. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. The Maryland Income Tax Estimator Lets You Calculate Your State Taxes For the Tax Year.

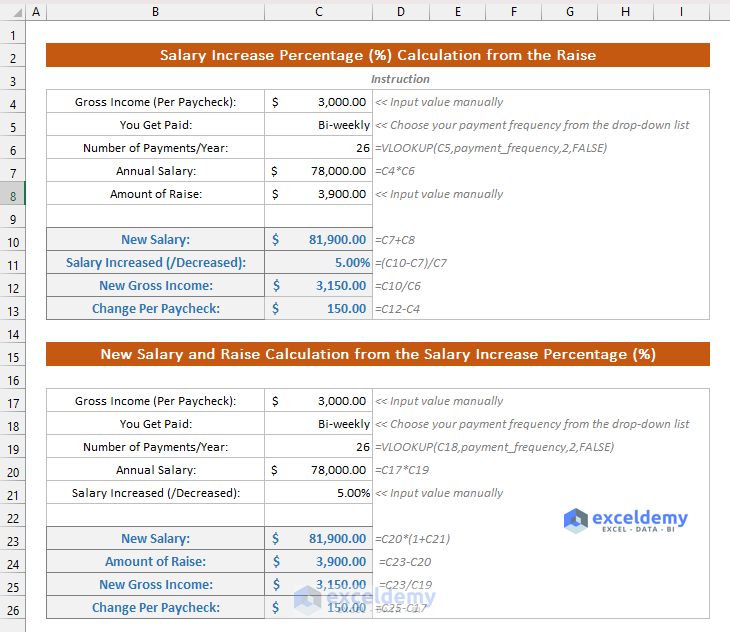

Tims Tax Service pays an average salary of 153951 and salaries range from a low of 135437 to a. Calculate how tax changes will affect your pocket. Taxable income Annual gross salary - Pension Provident RAF limited to 275 of salary limited to R350k - 20 of travel allowance You.

We have the SARS SBC tax rates tables built in - no need to look. The Federal or IRS Taxes Are Listed. This is how you work it out.

DOL is raising the total. Pay R356 for your first tax return paid upfront. The adjusted annual salary can be calculated as.

A basic tax return for those with a basic salary only. This places US on the 4th place out of 72 countries in the. And is based on the tax brackets of 2021 and.

If you have more than one IRP5IT3a please enter totals for all of them added. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Did you work for an employer or receive an annuity from a fund.

Tax Calculators Taxtim Sa

Salary Calculator Salary Calculator Calculator Design Salary

Browse Our Sample Of Salon Budget Template For Free Budget Planner Template Business Budget Template Budget Spreadsheet Template

Venn Diagrams For Borrowers Payday Loans Payday The Borrowers

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Tax Calculators Taxtim Sa

Salary Formula Calculate Salary Calculator Excel Template

Tax Calculators Taxtim Sa

Tax Calculators Taxtim Sa

Tax Calculators Taxtim Sa

Salary Formula Calculate Salary Calculator Excel Template

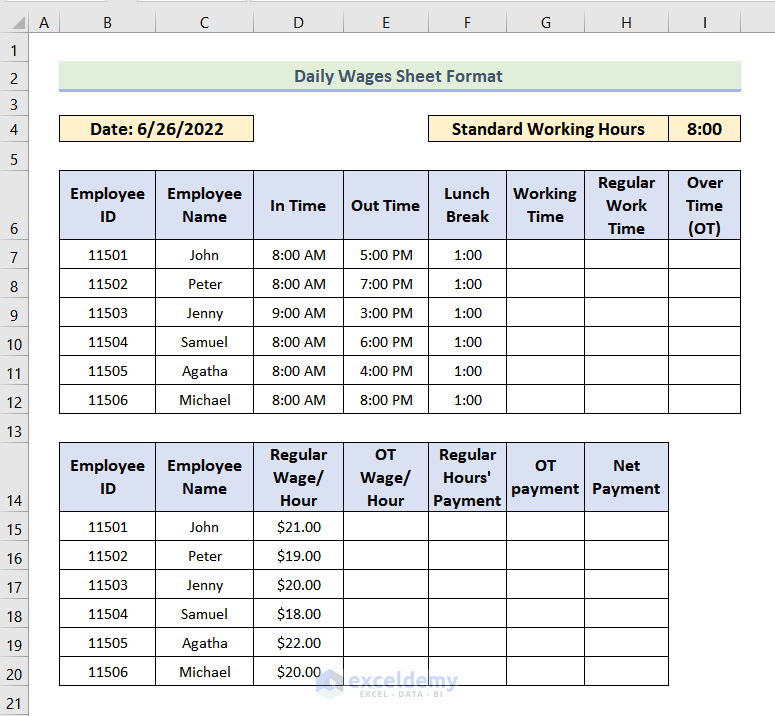

How To Calculate Salary Increase Percentage In Excel Exceldemy

Daily Wages Sheet Format In Excel With Quick Steps Exceldemy

Work Out Your Salary After Taxes At Maltasalary Com Salary Workout Tax

5 Tips For Handling Salary Requirements Careerealism Salary Requirements Negotiating Salary Salary

Tax Calculators Taxtim Sa

Calculate Salary Allowances And Tax Deduction In Excel By Learning Cente Excel Learning Centers Tax Deductions